All Categories

Featured

Take Into Consideration Utilizing the cent formula: cent stands for Financial obligation, Revenue, Mortgage, and Education and learning. Complete your financial debts, home mortgage, and university expenses, plus your salary for the variety of years your family members requires protection (e.g., till the youngsters run out your home), and that's your insurance coverage need. Some economic professionals calculate the amount you need utilizing the Human Life Worth ideology, which is your life time earnings potential what you're making currently, and what you expect to earn in the future.

One way to do that is to try to find business with strong Financial strength scores. 5 million term life insurance cost. 8A business that underwrites its very own plans: Some business can offer plans from an additional insurance firm, and this can include an added layer if you intend to change your policy or down the road when your family members requires a payout

What Is Voluntary Group Term Life Insurance

Some business supply this on a year-to-year basis and while you can expect your rates to rise considerably, it may deserve it for your survivors. An additional method to contrast insurance policy business is by considering on-line consumer reviews. While these aren't likely to tell you much about a company's monetary security, it can inform you how simple they are to collaborate with, and whether cases servicing is an issue.

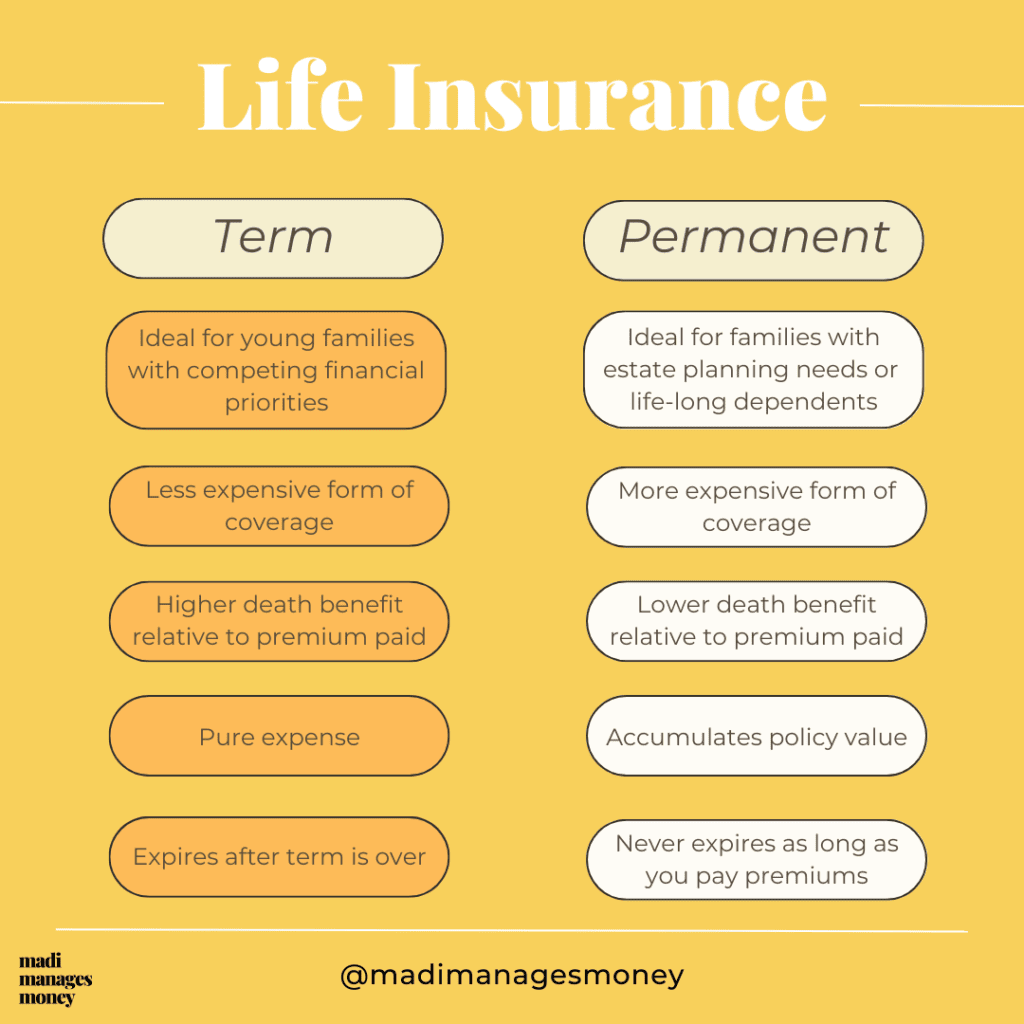

When you're more youthful, term life insurance policy can be a straightforward means to safeguard your loved ones. Yet as life modifications your economic priorities can as well, so you may wish to have entire life insurance policy for its life time insurance coverage and fringe benefits that you can make use of while you're living. That's where a term conversion is available in - after the extended term life nonforfeiture option is chosen, the available insurance will be.

Approval is guaranteed despite your wellness. The costs won't raise when they're established, however they will certainly increase with age, so it's an excellent concept to secure them in early. Figure out even more regarding just how a term conversion functions.

1Term life insurance policy provides temporary protection for a critical period of time and is generally cheaper than permanent life insurance. the combination of whole life and term insurance is referred to as a family income policy. 2Term conversion standards and constraints, such as timing, might use; for instance, there may be a ten-year conversion benefit for some items and a five-year conversion advantage for others

3Rider Insured's Paid-Up Insurance policy Purchase Alternative in New York. 4Not offered in every state. There is a price to exercise this rider. Products and riders are readily available in approved territories and names and functions might differ. 5Dividends are not ensured. Not all getting involved policy proprietors are eligible for dividends. For choose motorcyclists, the problem relates to the insured.

Latest Posts

15 Year Term Life Insurance Policy

The Term Illustration In A Life Insurance Policy Refers To

Funeral Schemes